If you are required to go airside for your business activities, you will most certainly require specific “airside” liability cover. Our insurance solutions are carefully constructed with the special needs of airport exposures and associated risks in mind. Our insurance solutions are underwritten by certain underwriters at Lloyd’s, ensuring they specifically meet the requirements for UK-based airside insurance cover.

Cover can include:

- High limits of indemnity – GBP 100m

- General liability

- Vehicle bodily injury

- Vehicle property damage

Terrorism & Political Violence

Standalone terrorism and political violence insurance provide the comfort your operation needs to mitigate risk in times of uncertainty and political unrest. From property terrorism to specialist risks like, cyber, kidnap and ransom, we can provide insurance solutions for your exposures.

Cover can include:

- Sabotage, strikes, riots and civil commotion

- Full political violence and war

- Standalone nuclear, biological, chemical, and radiological (NBCR)

- Loss of attraction and event cancellation

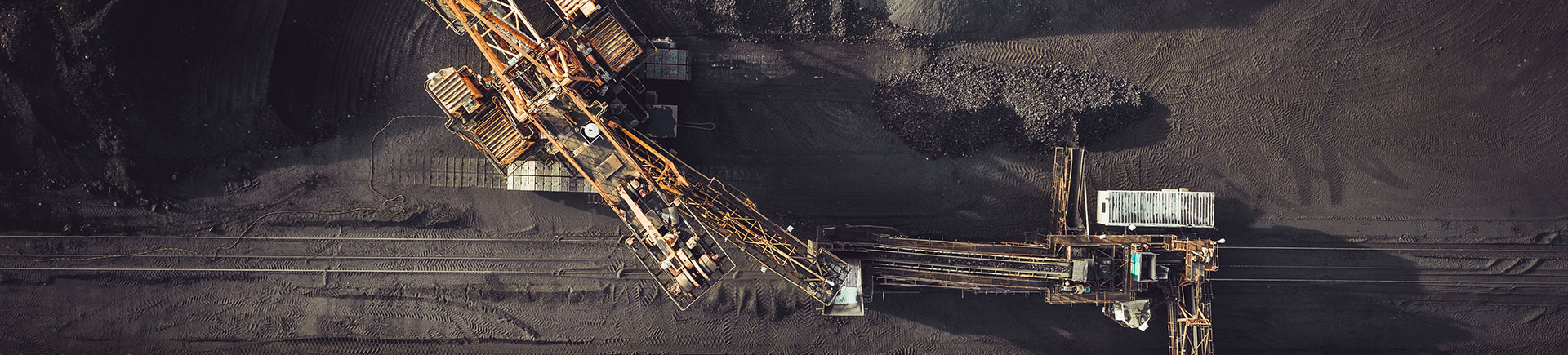

Engineering and Inspection

Statutory inspections are an essential aspect of ensuring safety in the workplace. If your business activities include the maintenance, repair and insurance of a property which contains a lift, boiler or pressure plant, we can help you find cover to protect you for inspection, breakdown and repair costs.

Cover can include:

- Statutory inspection and reporting

- Sudden & unforeseen damage

- Accidental damage, breakdown, explosion or collapse

- Temporary removal

- Transit cover (other than by sea or air)

Environmental Liability

Regulations mean that businesses are increasingly exposed to financial, legal and reputational consequences of dealing with pollution, as well as social and ethical responsibilities.

Even basic operations can give rise to complex issues and costly clean-up, which are usually not covered under a general Public Liability insurance policy including bio-diversity damage and statutory clean-up costs.

Cover can include:

- Pollution, statutory & environmental impairment liability

- Operational environmental risks

- Cover for clean-up costs

- Transportation environmental risk